Fly to Bucket-List Ski Destinations on Points

Ever wonder how I book international ski trips without draining a travel budget?

I don’t spend $15,000 a year on airfare. I use strategic credit-card welcome bonuses.

Last summer I booked a round-trip flight to Chile worth about $1,000 for 65,000 miles, less than a single card’s introductory bonus.

If you have a significant expense coming up—a new laptop, a major flight, even a medical bill—consider these options:

Pay cash or debit: no rewards, no purchase protection.

Use an existing credit card: earn 1–5 % back, a modest return plus standard protections.

Open a premium rewards card and place the purchase on it: meet the initial spend requirement and earn a welcome bonus often worth up to $2,000 in travel value, along with added protections and perks.

By timing new cards with planned purchases, I convert routine spending into premium travel. This method consistently funds my global ski trips without compromising comfort or financial discipline.

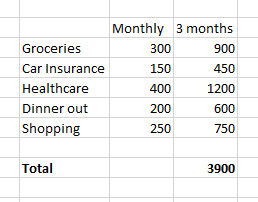

Now, $4,000 dollars might seem like a lot, but let’s add up what you might potentially already be spending:

Turn Planned Spending into Travel Leverage

You likely spend enough each month to meet most credit-card welcome-bonus requirements. A well-timed large purchase can unlock tens of thousands of transferable points—worth premium flights or upscale hotels—without changing your budget.

Credit Impact

Opening a card and paying in full can improve your credit profile over time. A larger total credit limit lowers your utilization ratio, which is 30 % of a FICO score. Expect a brief dip from the hard inquiry. Skip new applications if a mortgage or auto loan is imminent.

Key Practices

Set up automatic full balance payment on day one.

Never carry interest; it wipes out rewards.

Only consider 0 % APR cards if you need financing, but these rarely offer strong bonuses.

Choosing a Card

Each issuer has its own bonus limits (e.g., Chase “5/24,” Amex one-per-lifetime per product). Focus on cards with transferable points for maximum flexibility. If you favor a single airline like United or Delta, their co-branded cards add perks such as free checked bags.

I maintain about eight active cards but concentrate spending on two or three top earners and make small monthly charges on the rest to maintain an 800+ score.

Timing

Plan ahead to align the minimum spend with upcoming expenses. Some issuers provide a virtual card number instantly; Capital One and Citi are common examples.

Maximizing Points

Transferable points deliver the best value. For example, Chase Sapphire Reserve currently offers 80 k points—enough for a round-trip from Jackson Hole to Japan (about $2,000 in cash fares) or multiple domestic trips. Used as cash-back the same bonus equals about $800.

Chase Sapphire Reserve – Current Offer

Welcome bonus worth up to about $2 000 in airline transfers. The value easily offsets the annual fee for several years while delivering strong ongoing perks.

Standout Benefits

3x points on dining, 2x on travel, 1x on other purchases

$300 annual travel credit (hotels, flights, trains)

Primary rental-car insurance up to $40/day

Emergency medical and dental coverage while traveling

Trip delay, lost or delayed baggage, and trip-cancellation protection

Global Entry or TSA PreCheck fee credit

No foreign-transaction fees

Priority Pass lounge access for you and a guest

Extra Statement Credits

Up to $500 for stays in the Edit hotel collection

Dining, DoorDash, StubHub, and Lyft credits

Frequent travelers can easily recoup the $795 annual fee through the $300 travel credit, lounge access, and included protections. I value the lounge access most—six trips a year saves us roughly $500 in airport food and drinks.

Similar to the Chase Sapphire Reserve, the Preferred offers 3x points on dining and 2x points on travel, with an annual fee of only $95 instead of $795. While it doesn’t come with as many travel protections, credits, or lounge access, the current offer makes it a perfect card. Points transfer to many airlines, but the best value is United.

You can fly one way in the U.S. for as few as 7,500 points, which gives you up to six round-trip tickets or three international ones.

Runner up: Capital One Venture X

$395 Annual Fee

Similar to the Chase Sapphire Reserve, this card offers solid travel perks but with lower earning potential—2x points on all spending, making it easy to track but less rewarding. It includes most of Chase’s travel benefits, though it lacks accidental medical and dental coverage. However, it adds access to Capital One and Plaza lounges and allows free authorized users who also get lounge access.

The $300 travel credit must be booked through their portal, where prices are often slightly higher than on Kayak or Google Flights, so I value it closer to $250. If you spend over $5,000 annually on travel and dining, Chase sapphire will more than pay for the additional annual fee with added benefits.

Those are my two favorite points cards that offer great value, so pick either one or both and enjoy free flights!

Business cards

You actually don’t need an official business name or LLC to open a business credit card. If you’re just selling items on eBay or stickers on Instagram, that counts as a business! You can apply using your own name and Social Security number. If you have a EIN, you can open even more cards with that.

Right now, you can get 90,000 points on the Chase Ink card with only a $95 annual fee, which is insane value!

Or get an Amex card with 100k points that transfer to Delta or many other airlines.

If you’re finding this article helpful, please consider applying through my referral links; I’ll earn bonus points, too!

Redeeming Points

Earning points is the easy step, finding out the best way to redeem them is the hard part. I use PointsYeah to find award availability. It is the best site I've found to search for airline transfer partners from the credit cards you have. You simply select the cards you have, and it shows all available transfer options and lets you book directly with the airline. The free version is great for basic searches, but I recommend the paid plan, which allows you to search up to a week at a time instead of just four days. This makes it much quicker to explore multiple dates and airports at once.

PointsYeah is the easiest way I've found to start the search, then go directly to the airline’s website to confirm availability before transferring your points.

Now get out there and plan your next trip!